Capitalism and social inequality go hand-in-hand. Indeed, no country — at least, no capitalist country — has experienced an economic boom without also witnessing an explosion in inequality. For most mainstream economists, this inequality is an unfortunate but necessary side effect of capitalist development. For others, it’s part and parcel of what makes the system so attractive — after all, you can’t make an omelette without breaking a few eggs.

Milford Bateman is a freelance consultant on local economic development and a Visiting Professor of Economics at the Juraj Dobrila University of Pula. He is also Adjunct Professor of Development Studies at St Mary’s University in Halifax, Associate Researcher at the Fluminense Federal University (UFF) in Rio de Janeiro, as well as Honorary Research Associate at the Royal Holloway College of the University of London.

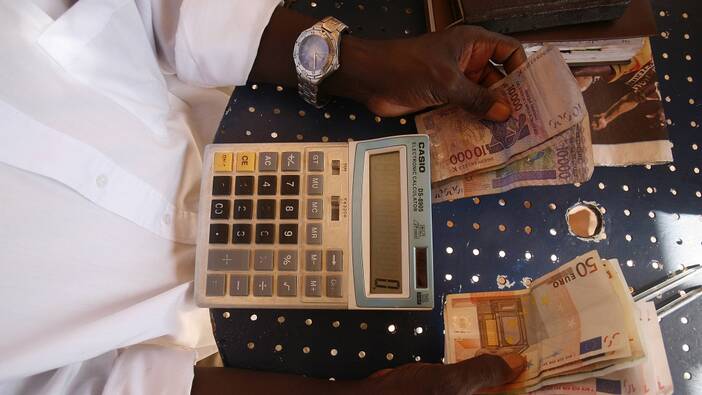

Over the last few decades, however, we’ve witnessed the emergence of another kind of capitalist discourse: that of financial inclusion. Beginning with the “microcredit” craze in the 1990s, more and more economists claim that inequality will not be solved by regulating the market or growing the welfare state, but rather by unleashing financialization. The logic behind the argument is that, by granting poor people access to markets via microloans, online banking, and other tools, they will unlock new financial and entrepreneurial opportunities with which to drag themselves out of poverty.

The appeal of this approach for the rich and powerful is evident, as it allows them to express concern for social inequality without problematizing their own wealth and its role in generating that inequality to begin with. But has financial inclusion actually made a difference for poor people in the Global South? Fabio De Masi spoke with developmental economist Milford Bateman as part of his The Future of Money in Africa dossier for the Rosa Luxemburg Foundation to find out.

The Promise of Financial Inclusion

The FinTech industry and some developmental advisors claim that financial inclusion uplifts the poor. Similar hopes were initially raised about microfinance. What is your perspective on financial inclusion as a means to address poverty?

It is a rather bizarre story. Beginning as simply microcredit, it soon evolved to include other financial services — savings, insurance, leasing, and so on — and now referred to as microfinance. The leading advocate and 2006 Nobel Peace Prize winner, Muhammad Yunus, repeatedly announced that microfinance would eradicate global poverty in a generation.

Microfinance was first popularized in the 1980s in Bangladesh and Bolivia. By the late 2000s, however, the sour reality began to kick in: microfinance didn’t actually work. In spite of hundreds of billions of dollars of microloans dispersed to the global poor, it was not possible to detect any meaningful net positive impact on global poverty.

The conventional wisdom began to acknowledge that it had indeed failed to transform the Global South, but it had provided some benefit to some of the global poor. This, for example, was the view of the 2019 Nobel Economics Prize winners and one-time leading supporters of the microfinance model, Abhijit Banerjee and Esther Duflo. They were then forced to change their minds and admit that the correct interpretation of the evidence was that microfinance had had little to no real positive impact.

You go even further by arguing financial inclusion may hurt the poor. How so?

Microfinance institutions have extracted huge economic rents from the poor. It is no coincidence that we find the most damaging impacts of microfinance in precisely those locations where it has gained most traction: Bosnia, South Africa, Cambodia, India, Bolivia, Kenya, Colombia, Peru, Sri Lanka, and others.

In these countries, microfinance institutions evolved into some of the most profitable operations in the world. Most of their clients languished in poverty but, hoping to do better, were all too often plunged into even deeper debt. They lost their collateral pledged against a microloan — such as housing, land, equipment, and so on — and saw their communities “dumbed down” to the point where few productivity-raising jobs remained in existence.

But did microfinance achieve financial inclusion?

Yes, by the 2000s the microfinance industry had extended financial inclusion in the Global South to new heights, achieving what we might call “nearly full” financial inclusion. This was celebrated at many regular events, notably those put on by the influential Microcredit Summit Campaign.

Many financial innovations start out as beneficial to the poor, but the problems start when such financial innovations are then commercialized and privatized.

It is a useful thing for the global poor to have more and better financial services at their disposal, but the key is the way that financial inclusion is designed. To date, financial inclusion is not about addressing global poverty so much as continuing the building of financial markets that include the poor as clients in order to benefit global investors.

So why are we still discussing financial inclusion 20 years later if it failed to reduce poverty?

When it became clear in the late 2000s that microfinance was not working, progress in advancing financial inclusion was now described as “not enough”. It was argued that we now urgently needed to “go the last mile” in order to achieve “full” financial inclusion.

How come that “nearly full” financial inclusion had no real impact on global poverty levels, yet facilitating just a little bit more financial inclusion will now do the job of ending global poverty? This widespread claim made absolutely no sense. Yet it was, and still is, very widely believed.

Why so?

The claims around financial inclusion are, in fact, nothing but a cover-up for continuing to expand the supply of microfinance. Remember that the microfinance industry in the 1990s began to realize that “oh boy, we can actually make a hell of a lot of money” by stretching out their financial tentacles — one might say — down into the poorest communities. A couple of examples, such as Compartamos Banco México, SKS Microfinance Limited in India, and ACLEDA in Cambodia, demonstrated that with the right organization, sufficient scale, and the creative use of collateral, a large enough microfinance institution can make a hell of a lot of money for its CEO and its investors.

What happened to clients, and also their communities, was simply not of any real interest to investors, no more than Wall Street’s financial institutions took any time to consider how ramping up the supply of hugely profitable sub-prime mortgages would ultimately impact the hapless individuals who signed up for them, many in minority communities.

The explosive growth in the global supply of microfinance happened in the 2010s under the cover of “expanding financial inclusion”. This growth was really driven by the investment community, the CEOs, the shareholders, and even many external advisers who all earned extremely well from it. Moreover, this rapid growth was also driven forward by the international development institutions, such as the World Bank and USAID, and by key Western governments, notably the US and UK governments.

The Emergence of FinTech

How does FinTech relate to microfinance?

Fintech is often described as “microfinance on steroids”. It’s clearly the next phase in the evolution of the microfinance model.

The story started at the end of the 2000s when it became clear that microfinance hadn’t worked and, even worse, that it was associated with a lot of negative economic and social consequences for the poor. But at this precise juncture you had this innovation emerge called FinTech (financial technology) that effectively rendered obsolete the old “brick and mortar” microfinance model and catapulted microfinance into the digital age. Investors saw an incredible opportunity and went for it. An entirely new round of profit extraction at the expense of the global poor had opened up.

Are there no benefits to providing financial technology to the poorest?

Many innovations, including financial innovations, start out as beneficial to the poor. But the problems start, in general, when such financial innovations are then commercialized and privatized. Once private FinTech corporations conquer a critical customer base and become oligopolists, or even monopolists, which is the goal of those scalable data-driven business models, the situation radically changes. The poor are no longer the beneficiaries of a particular financial innovation, but increasingly its hapless victims.

We first saw this in the case of M-Pesa in Kenya, the iconic money transfer platform that effectively gave rise to the global FinTech movement in the early 2010s. M-Pesa was started with the help of the UK's international development agency at the time, DFID, and everyone involved professed to having good intentions and they hoped that M-Pesa would be “a great way of helping Kenya’s poor”. Rafts of academic development economists were immediately provided with generous funding to back up the M-Pesa story.

But then the parent company, Safaricom, within which M-Pesa operated, inevitably came under investor pressure, and it quickly morphed into one of the most exploitative corporate titans in Africa, if not the world. Its profits exceeded many Western corporations. Even worse, other FinTechs are emulating that model now.

M-Pesa had become an innovation that extracted value from Kenya’s poor. This is now increasingly recognized by scholars and development economists, and some practitioners. To an extent, the Kenyan government since around 2020 also began to try to rein in Safaricom and other newly formed FinTech platforms, such as by tightening regulations, increasing taxes, and so on. But, so far at least, the impact of these recent efforts has been minimal.

Funding Investment or Funding Survival?

The usual story of how financial inclusion would uplift the poor goes like this: the underbanked receive loans which in turn enhance productivity by allowing them to purchase better tools or fertilizer in agriculture, or by providing inventory for small-scale entrepreneurial activities. If we look at microfinance and FinTech, did that materialize?

Well, let’s look at the experience of South Africa after Apartheid. Microfinance was aggressively pushed in the early 1990s by institutions such as the World Bank, the International Monetary Fund (IMF), and the US government. Their argument was that more microfinance would support mass entrepreneurship among the Black population, and quickly deal with the appalling legacy of poverty, unemployment, and deprivation.

However, the microfinance model turned out to be a disaster for the country’s Black population on several fronts. The amounts involved in microloans were so tiny, by definition, that it mostly supported “survivalist” entrepreneurial activities that, collectively, had little to no sustainable impact on the well-being of the wider community.

Yes, South Africa saw many new microenterprises get started with the help of microfinance, and a tiny few did quite well, but almost as many of these new entrants quickly collapsed. Others ended up making almost no financial return, struggling to stay in business any way they could, including through unethical and sometimes illegal means.

You did not get sustainable poverty reduction, therefore, but simply what economists have termed “job churn” — the constant entry and exit of simple microenterprises, a process that has little to no positive impact on local economic development. As one of the world’s leading development economists, Ha-Joon Chang, has noted, if microenterprise activity really does have such positive impacts then Africa as a whole should already have been far more successful, as it has the highest number of microenterprises per capita compared to any other region in the world.

Hence, those loans did not boost investment and productivity?

Microenterprises are simply not going to increase the rate of productivity growth in Africa, or anywhere else. So, providing these expensive tiny microloans, and now even more expensive digital microloans, really doesn’t allow these microenterprises or the local economy to flourish. Yes, the very few microenterprises that did well in Africa were celebrated, given awards, and presented to the public.

However, this tactic is a bit like the lottery. You could equally argue that the lottery does away with poverty because you see some winners who now drive a Rolls-Royce. But you can only conclude this if you ignore the fact that the overwhelming majority lost the money they spent on their lottery ticket.

When you’re building massive microfinance institutions, you get to a point where you can’t be bothered with the cost and hassle of organizing these groups of ten women to create social pressure around debt service, so you increasingly revert back to traditional forms of collateral.

Most microfinance advocates ignore important downsides, most notably the exit phenomenon, as even lead economist at the World Bank, David McKenzie, recently admitted was the case, because it enables microfinance advocates to better keep on “selling” the microfinance model to governments in the Global South.

How were those loans then used instead? Do most microloans finance consumption rather than business and investment?

The users of microloans not surprisingly began to realize the futility of starting a new microenterprise, arguing something like: “I can’t make it as a street vendor as there are already 20 vendors in our street. Life is too short, so let me at least take the loan and buy food, fund my kids’ education, or pay for a medical emergency of a relative!” Many hoped that, in future, formal employment or an inheritance or a gambling win would come up and help to service the debt.

So, the use of microloans shifted to satisfying consumption needs rather than investment in a microenterprise. And that is where even more problems began to arise, because if the microloan does not kick-start additional income generation, how do you then service the debt?

The inevitable end result was that countries such as South Africa were turned into economies with some of the highest household debt ratios in the world. Kenya, Rwanda, Tanzania, and other countries had a similar development, but South Africa stands out in many respects.

Winners and Losers

Who were the winners and losers in that microfinance game in South Africa?

Apart from a tiny number of success stories, or outliers, the Black community in South Africa didn’t really benefit from microloans. But for those on the other side of the equation — the lenders and investors — things went, well, brilliantly.

The lender and investor class is composed of the old financial elites of South Africa which stood behind Capitec Bank and African Bank, at one time the two largest microcredit banks in the country. For a long time, Capitec Bank made spectacular profits from unsecured microloans while knowing that pouring expensive microloans into the most vulnerable communities – such as the mining workers in South Africa — was clearly doing more damage to clients than good.

However, these two microcredit banks grew very fast indeed by bringing in many millions of new clients from the very poorest Black communities. They hoped to use the vast profits earned on their risky unsecured lending business to eventually become mainstream banks.

Indeed, in the early 2010s Capitec Bank was on the verge of collapse. Its share price tumbled and its CEO was forced out. But then, rather fortuitously for Capitec Bank, its main competitor African Bank collapsed and that saved Capitec Bank. Having survived by the skin of its teeth, Capitec Bank’s owners and its new CEO opted to take their massive earnings off the table and begin a shift into new, less risky business areas, such as serving wealthy South Africans and funding established formal SMEs [small and medium enterprises]. Now there is TymeBank, which moved into the unsecured loans space with the help of FinTech.

A rising supply of microcredit made a tiny percentage of South Africa’s mainly Afrikaner business elite spectacularly rich. Just look at the “100 richest individuals in South Africa” list and you’ll see so many of the senior executives and key shareholders from Capitec Bank on that list. But microfinance did nothing for the poorest Black communities. Put simply, the Black communities didn’t really need microcredit — they needed small business credit on affordable terms and maturities, as well as business and technical support. But that’s not what they got.

It seems financialization and microfinance ease a contradiction that arises from weakening the share of labour in income distribution: it supports poor people’s consumption demand via consumer debt while allowing for poverty wages to be sustained. However, how do borrowers service debt when their businesses fail?

Well, a lot of already employed South Africans began to access microcredit simply to survive until their next pay cheque. This opened up the possibility for the microfinance institutions to use so-called garnishee orders. These entitled the microfinance institution to automatically deduct the microloan instalment from the wages the debtors received via their employers.

The garnishee system hence insulated the microcredit institutions from the risk of default as they could directly access a proportion of their debtor’s wages to repay the microloan – sometimes up to 50 percent. That system I understand is now being challenged because it created massive social devastation, but in the meantime huge amounts of value have been unethically extracted from the Black communities.

Microfinance started with social collateral where the microcredit institutions would form borrower groups of, say, ten women so that if one of them didn’t pay their microloan, all the other nine members in the group had to chip in an amount to cover the payment. This was a revelation in the financial world as it meant that the poor in the Global South were, for the first time, seen as “bankable”.

But things changed over time. When you’re building massive microfinance institutions, you get to a point where you can’t be bothered with the cost and hassle of organizing these groups of ten women to create social pressure around debt service, so you increasingly revert back to traditional forms of collateral.

In Cambodia, more than any other country in the world, clients now have to hand over their land title as collateral, and if you can’t honour your debt the microfinance institution informally forces you to sell your land to repay your outstanding debt in full. In Bosnia, you had to sign up two individuals from your circle of family and friends who would then guarantee to repay your loan if you defaulted. In places like South Africa, they pioneered this garnishee order.

What were the kind of problems caused by the garnishee system in South Africa?

The garnishee system was also a factor in precipitating the most atrocious example of state violence since Apartheid – the Marikana Massacre in 2012 that saw the South African Police Service (SAPS) kill 34 unarmed striking mine workers.

The problem was that a lot of the striking miners around the mining region of Rustenburg were financially illiterate and so, as often happens, got deeply into debt with the main microfinance institutions, several of which were located on the mine premises. Moreover, many of the miners were recruited from the even poorer rural regions as they were seen as more compliant. But having to support two households — one on the mine and one in the rural areas where they were recruited from — they needed a decent enough income to sustain this arrangement.

All microloan companies initially offer services cheap as they need to rapidly build up a client base, but as sure as the sun rises tomorrow, in a few years’ time they’ll start to raise the prices of all of the services they offer.

The mineworkers most affected by debt thus saw an increase in salary as the only way to float themselves off their debt burden and start afresh. The mining corporations refused to concede, which led to the strike by mineworkers that eventually led to the massacre.

Some observers already speak of a “debtfare state”. Do you agree?

I very much agree. The political scientist Susanne Soederberg shows that the post-war welfare state is in many locations in the process of being replaced with the “debtfare state” — a state wherein the poor increasingly have to pay for key services they need by accessing microcredit. This forces the poor to engage with the informal sector full or part-time at almost no matter what the financial return, accept poverty wages from formal businesses, run down family assets, avoid strike action if employed, all in order to maintain repayment on their microloans.

The end result, as intended, is a far more disciplined, flexible, and cheaper workforce operating at the bottom of the pyramid. As is clear, this trend is good for investors and elites, but not for ordinary people.

The M-Pesa Example

A lot of FinTechs are not very transparent about their business models. Do you have a specific example, let’s say on the fee structure that the M-Pesa platform or TymeBank in South Africa use?

Yes, just look at one of the world’s biggest universal unconditional cash transfer programmes in Kenya.

It happens to be funded by several US billionaires through a non-profit foundation called Give Directly. It is huge in terms of the per capita cash transfer that people are getting. It also uses a mobile phone money transfer service as well — the privately-owned M-Pesa money transfer platform. The problem that arises here, however, is that, depending on how much you take out of your basic income as cash money at any one time, you must pay a sizeable fee to M-Pesa.

Now, M-Pesa and the US-based development economists evaluating this programme had no great interest in discussing the details of the fee structure as, I am guessing, they felt it might suggest that Safaricom, M-Pesa’s hugely profitable parent corporation, was making a lot of money from a well-meaning anti-poverty programme.

However, a Give Directly official I was in contact with confirmed to me that M-Pesa does not provide any “special discount” to those receiving cash through the Give Directly programme, and so clients are routinely charged anywhere from 5 percent to as much as 20 percent of the total value of the small amounts of cash they take out. That can be a significant amount of money to lose if you are poor.

So M-Pesa had no real benefits for the poor?

You must remember that initially M-Pesa was seen as very cheap. The alternative at that time in the early 2010s was putting your money on the bus in the hands of the bus driver or a friend and sending it to your mother in Nairobi. When you were able to send it by mobile phone, then it was indeed much cheaper.

So, I accept that initially this technology released a lot of value to the ultimate consumer. But Safaricom were fine with this because they wanted the word to go out and to build a market. Once they achieved that goal, however, and after attaining a near-complete monopoly, including through extremely unethical means, then the situation changed and they began to exploit the clients using their specific market power.

In essence, all microloan and FinTech companies initially offer services cheap as they need to rapidly build up a client base and scale up their business in order to lower the costs of their operations. But as sure as the sun rises tomorrow, in a few years’ time they’ll start to raise the prices of all of the services they offer because, they hope anyway, you’ll be locked into their network.

Pointedly, the only time Safaricom agreed to lower M-Pesa’s ultra-high fees on its money transfer services was during COVID — but it was not by choice. There was so much anger at how much M-Pesa was charging the poor to send and receive money during this once-in-a-century emergency that they had to be forced into it by the Kenyan government.

Safaricom also angered many in government by insisting on continuing to pay out the same sizeable dividends to its extremely wealthy foreign investors during COVID, notably by paying more or less the same dividend as in previous years to its majority shareholder, the British telecom giant, Vodafone. It appears Vodafone wanted its usual tribute quite regardless of the difficult situation in Kenya, and Safaricom’s senior management went along with this.

What role does Vodafone play as majority shareholder?

Pointedly, the UK’s Vodafone is a famous tax avoider, paying almost no corporation tax for many years by using a large number of Vodafone subsidiaries across the world that are separate taxpaying units. Many newspapers, such as the Guardian, have called them out on this deceptive, although not uncommon, tactic.

Vodafone eventually responded in their annual report by essentially saying that, “Yes, it is true we pay no corporation tax. However, we are one of the biggest spenders on vital telecom infrastructure in the UK which we fund out of the inflow of dividends we receive from abroad.” In their annual reports they note that a sizeable part of their dividend flow they receive is from their 40 percent majority ownership of Safaricom.

So, think about this: Vodafone Plc finances its telecoms investments in the UK, which are vital to UK development and growth, out of the dividends it receives from the profits that are extracted from some of the poorest communities in Kenya.

People-Centred vs. Investor-Driven FinTech

You recently stressed positive examples in Brazil of how financial technology embedded in public or municipal banks could benefit local economic development. Could you explain this a bit?

There is a very interesting movement in Brazil trying to link financial technology to local development. It started in the city of Maricá near Rio de Janeiro. Maricá has long been characterized by a high degree of poverty.

Fortunately, Maricá is governed by President Lula’s Workers’ Party (PT), which means it is far more open to pro-poor initiatives that address poverty, as opposed to the all-too traditional type of initiatives that mainly enrich the already wealthy. Furthermore, Maricá has a very big benefit as in their territorial jurisdiction they have much of Brazil’s offshore oil and gas industry, which is mandated by central government to pay a certain amount of royalties to municipalities affected by their activities.

Maricá has a conditional basic income programme that is paid out through their community bank (Banco Mumbuca) in a local currency (the Mumbuca) using a FinTech platform. It works very well to provide important financial services to the community. The Mumbuca Bank introduced a credit card and later an app on mobile phones to pay out a conditional basic income without the intervention of, for example, Visa, MasterCard, or PayPal.

Enticing the local citizens to pay bills using their mobile phones saves the municipality a lot of money. In return, it funds the municipal bank which supports local enterprise development. The value generated by using FinTech, which is usually appropriated by the private sector, is thus now used for the public benefit.

They operate without any charge levied on the poor by profit-driven banks or the digital payment corporations. There is no charge to the recipient when receiving the basic income that is paid in Mumbuca. In other words, you get 100 percent of the amount that is officially due to you. Mumbuca Bank covers its operating costs by charging the many local businesses that accept the Mumbuca a 1-percent fee to convert any Mumbuca they receive from recipients of the basic income into the Brazilian currency (the real).

Maricá municipality wanted to generate benefit wherever possible for local citizens through the expansion of basic financial services that improve their lives, not extract as much value from them by, say, selling as many expensive digital loans to them as possible in order to maximize profits, which is the typical motive of the type of FinTech platforms established and operated by investors.

To what extent have oil and gas revenues facilitated the Maricá experiment?

Having a major revenue stream from the oil and gas industry is naturally of benefit to Maricá, but into the longer term this benefit will disappear if not managed sensibly. Maricá officials appear to be willing to examine the many bad examples of mismanaging the wealth generated by such a natural resource bounty.

One obvious example is that of Scotland. It had 60 percent of the North Sea oil, while 40 percent lay in Norway’s territory. The UK government centrally managing Scotland’s oil and gas sector favoured the private sector taking the lead in developing the sector and in creating benefits for the Grampian region, where the oil and gas sector was centred. A few institutions were created but they were weak and ill-funded, and some were eventually closed down. Crucially, the royalties were mainly used to fund the huge welfare payment bill arising from the extremely high level of unemployment created in the 1980s and 1990s by the ideologically driven Thatcher government’s forced closure of many of the most heavily unionized industries in the north of England, the Midlands, Scotland, and Wales.

Norway’s government, on the other hand, adopted a decentralized “institution-thick” approach. That approach was based on supporting regional R&D institutions capable of developing and introducing new technologies and new businesses linked to the oil and gas industry.

Billionaires like Mark Zuckerberg and Peter Thiel believe it is better to address poverty with some money so that people are a little less poor but, crucially, the rich can pretty much go about their business and lives as usual.

As the North Sea oil and gas boom is now coming to an end, one can compare the results. The benefits of the oil and gas find in the Grampian region of Scotland, and across Scotland and the UK as a whole, are barely discernible. Many of Scotland’s regions are slowly deteriorating, having derived little benefit from the oil and gas boom.

Norway, on the other hand, is now one of the world’s richest countries, with a high level of technological expertise in many oil and gas-related areas and having developed many leading technology-based SMEs. And, of course, with its huge sovereign wealth fund to fall back on, the excellent progress can continue well into the future.

The politicians in Maricá wanted to figure out how they could use such oil and gas revenues to foster innovation and ensure a much higher level of social development. While President Lula introduced a well-regarded cash transfer programme called Bolsa Família during his first term in office, the oil and gas royalties allowed Maricá to go even further. This was how they were able to establish an additional cash transfer programme, which was then extended during COVID.

Crucially, Maricá has also established its own modest sovereign wealth fund in order to ensure that the key elements of the Maricá model can be maintained into the future. But the key here was really the use of FinTech in such a way as to benefit the entire citizenry.

Is Maricá the only example of people-driven FinTech?

Maricá was probably the first example in Brazil. Now there is another bigger city — Niteroi — with about 1.3 million people, compared to Maricá’s 250,000 inhabitants, which is looking into this. On my latest research trip to Brazil, we also heard that several other cities are studying these “people-centred” FinTech experiments and are introducing their own arrangements similar in many respects to Maricá.

We’re also currently hearing about some smaller parts of São Paulo trying to link basic income and FinTech. In Brazil, it is important that community currencies can be easily and at low cost redeemed in the real, and used to purchase goods and services from anywhere. This matters, as most local currencies failed in the past due to the inability to use them for transactions outside of the specific municipality or region.

A lot now depends on the attitude of the central government. The incoming government under Lula is very much geared towards poverty reduction and trying to repair the damage of the Bolsonaro regime. I understand that the Lula presidency is interested in using innovative ways to use financial technology that can be deployed nationwide to reduce dependence on the likes of PayPal, Visa, JP Morgan, Goldman Sachs, or Barclays.

This is a very interesting development and the FinTech efforts underway elsewhere across Brazil, including in Maricá, could be useful experiments to assess.

If I understand correctly, the Maricá basic income is a conditional social grant and hence clearly targeted at the poor?

Yes, Lula’s Bolsa Familia is targeted at the bottom 10 or 15 percent of income distribution if I remember correctly. Those were conditional cash transfers because often you would expect the household to make sure their kids attended school or make sure they went for their vaccinations. That was still prior to COVID. Now, the unconditional basic income in Kenya administered via M-Pesa is different. You receive it on your mobile phone through M-Pesa every month and you go out and spend it as you wish.

The libertarian right doesn’t like conditional cash transfers because you shouldn't be telling people they should take their kids to school and so forth. I disagree on this. I think people don’t need just incomes, they also need fulfilling jobs to be part of the community. Just having an income and doing nothing solves very little and changes very little. It simply eases the pain a little and, crucially, lowers the chances that the poor will totally reject the capitalist system.

That is why the billionaires such as Mark Zuckerberg and Peter Thiel and the like support a universal basic income. They believe it is better that you address poverty with some money so that people are a little less poor but, crucially, the rich can pretty much go about their business and lives as usual. The Brazilians do basic income, however, in a way that is beneficial, and so acceptable, to a broader working-class constituency.

How important is reaching scale in such public FinTech developments, and what kind of larger public banking infrastructure is required to provide municipalities with the technological capacity to establish successful community currencies?

Maricá used the extra income coming from the oil and gas royalties and expanded the scope of Bolsa Familia. They target people who fulfil certain criteria — I think 40 percent of the population are now eligible. This is huge.

So, now you are starting to get to critical mass because 40 percent of the population are in possession of the local currency, the Mumbuca. That is why businesses are saying: “Wow, that's a fair big slice of local demand so I’ve got to sign up for the Mumbuca to make business!” So, you see the signs outside big supermarkets saying “we take Mumbuca”. Scaling up has been vitally important in making the Maricá model work.

It is also important to the discussion here that Brazil at the national level has also pioneered a public payments system, termed Pix, that since 2020 allows for free financial transactions between individuals, businesses, and government. Pix saves a huge amount of money that would otherwise go to the digital payment corporations, such as Visa, MasterCard, and PayPal. If the US and EU pay as much as 2.3 percent and 1.4 percent of their total GDP in payment costs, one gets an indication of how much money can be retained in Brazil’s communities thanks to Pix.

Likewise, local digital community currencies operated by community-owned FinTechs will allow the community to control their own local financial system. In that way, the tiny financial transactions that are made are not “mined” by investor-driven FinTechs and the value transferred out of the community.