Powerful digital companies have arisen in China with applications on the cutting edge of technology. Meanwhile, it is the state that provided them with the necessary infrastructure (see text 3), and there is hardly any other country where social acceptance for their services and applications is as widespread as it is in China. These are ideal conditions for developing platform capitalism with Chinese characteristics.

Timo Daum is an author and social theorist whose research focuses on digital capitalism.

Translated for Gegensatz Translation Collective by Joseph Keady and Marty Hiatt.

Platforms are a relatively recent phenomenon. Twenty years ago, Google, Facebook, and their Chinese counterparts were still nascent or didn’t even exist yet. Today, however, this Silicon Valley innovation is well established in a number of industries. The platform is a new form of organized capitalist exploitation, or what sociologist Boy Lüthje calls a “sectoral accumulation model”. In some industries, it is at the core of value creation or capital accumulation, including in transport, where Uber is the most notorious example.

There are currently 112 cities with over one million residents in China, and that figure is increasing. They all have rapid growth in common and car ownership is increasing with it, resulting in significant traffic and environmental problems. For that reason, the populace is relatively open to new forms of transport.

Nonetheless, many people will not be able to afford a car in the foreseeable future; licensed drivers make up 27 percent of the Chinese population, as compared with 70 percent in the US. According to a 2016 World Economic Forum study, 75 percent of Chinese citizens would be willing to ride in a driverless car. As the world’s largest domestic market, China therefore has strong market potential for the services that transport platforms offer.

A Large Playing Field

Chinese start-ups are as important for ride sharing and autonomous driving as they are for battery-powered electric vehicles. In China’s transport sector, the interplay between private innovation, platform-capitalist business models, and normative guidelines can be viewed from the state’s perspective. State environmental and development objectives converge with apparently lucrative business possibilities in a dynamic start-up landscape simply because of the size of China’s population.

In May 2020, Chinese Minister of Transport Li Xiaopeng encouraged both city administrations and businesses to start pilot programmes with robo-taxis. Yuan Yang, China tech correspondent for the Financial Times, emphasizes the specific laissez-faire approach of the Chinese government, noting that, “with customer-oriented technologies that have no apparent political implications or content, the Chinese government is very relaxed. It allows entrepreneurs to try out innovations and only subsequently monitors or regulates them as needed.”

Along the way, China is taking the path that it already established when it developed its digital sector: first, copy the US original and seal off the domestic market until local actors have built powerful corporations, then regulate and export its own business model as needed.

Planned Experimentation in Shenzhen

With a population approaching 20 million, Shenzhen is also considered a shining example of China’s policy of experimentation and planning (see article 3) in the transport sector. Ulrike Reisach, a China expert and professor at the Neu-Ulm University of Applied Sciences, calls Shenzhen a “showcase city for central traffic control, but also for electric mobility”. In less than a decade, the city has managed to reduce its average air pollution by 50 percent (Nylander). Of China’s 20 largest commercial capitals, Shenzhen is the only one that meets all national standards for air quality.

An estimated 83 million people do work through platforms in China, but only five million of them are employees.

The Shenzhen Urban Transport Planning Center (SUTPC), a powerful institution that manages traffic in the city, plays a key role. The SUTPC was founded in 1996 as a “national high-tech company in the field of urban transportation research” that, by its own account, has matured into the “provider of total urban solutions”. The data that accrue in the city are important resources in that process; Shenzhen is a global leader in analysing its population’s smartphone GPS data and digitizing its transport infrastructure.

Journalist and China specialist Wolfgang Hirn writes that “Shenzhen’s car policy is a model of cooperation in this city: the city administration works together with state-run and private business. Every cog interlocks.”

Didi Chuxing: Bigger than Uber

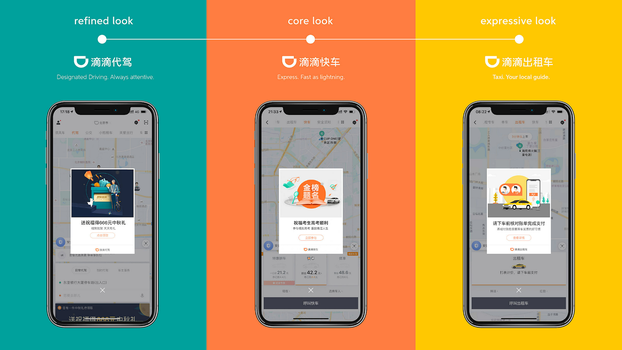

The ride-hailing operator Didi Chuxing is considered the Chinese Uber. Its app allows people to book rides in private cars and taxi. The Beijing-based start-up was the product of a merger between two existing companies.

Competition with Uber ended in 2016, when Didi Chuxing took over all of Uber’s Chinese business and gave it a percentage share in Didi. Didi Chuxing is valued at 56 billion US dollars and its business also includes deliveries and bike sharing.

The company is working with auto manufacturers to expand its electric fleet and experimenting with a driverless transport business. In just a few years, Didi has become the world’s leading transport technology platform.

Didi Chuxing handles around 25 million rides in Chinese cities every day, which is twice as many as all other ride-sharing companies globally combined. It has an estimated 15 million drivers under contract and they support over 550 million users daily.

It offers eight different types of rides, including the discount express rate, which guarantees air conditioning and an electric vehicle and costs about 17 yuan (roughly 2.38 euro) for a six-kilometre ride. Within China, Didi has “completely changed people’s attitude toward using taxis over private vehicles”, write professors Boidurjo Mukhopadhyay and Chris Chatwin.

Platform Labour with No Rights

Since it was founded in 2009, Uber has been criticized for the poor working conditions of its drivers (most of whom are formally self-employed), opaque communications and pricing, data leaks, and abuse — the list of transgressions is long. Moreover, transport research has repeatedly shown that the spread of Uber’s business model has resulted in increased traffic and drawing people away from public transport.

The situation with Didi Chuxing is very similar (and other platforms in China, like the very popular delivery services). Criticism of its monopolistic position, drivers’ dependency and isolation, poor working conditions, and a lack of rights are endemic. Just like Uber, there have been cases of assaults against passengers. Moreover, drivers’ self-organizing efforts have been suppressed.

An estimated 83 million people do work through platforms in China, but only five million of them are employees. For a long time, working as a casual labourer with scarcely any rights and no contractual regulations at all was a common way to earn a few yuan. In November 2020, workers at the delivery service Kuaidi went on strike in several cities over back wages and pay cuts due to competition between express delivery companies. Because the workers had no formal contracts with the company, they had few legal options at their disposal.

In response to growing public criticism and a series of high-profile cases, the Chinese Ministry of Human Resources and Social Security published new guidelines in July 2021 in order to strengthen the rights of platform workers and standardize contracts. According to Chinese platform-economy expert Chris Chan, who researches labour markets in Hong Kong and China, the guidelines defined the concept of an “incomplete employment contract” and articulated and implemented basic labour protections for platform workers, including a minimum wage and accident insurance.

Crackdown: State Regulators Strike Back

As Chinese regulatory authorities have worked to curb digital corporations in general since early 2021, even Didi has felt the power of politics: last year, the Chinese government initiated a harsh crackdown on the company. It followed on the heels of Didi’s listing on the New York Stock Exchange (NYSE), where the company had garnered a 4.4-billion-dollar IPO, the largest by a Chinese business since Alibaba.

Shortly thereafter, the State Administration for Market Regulation (SAMR) began investigating Didi for its pricing and competitive practices. On 4 July 2021, the Cyberspace Administration of China ordered app stores to remove Didi due to its violations with respect to collecting and using personal information. Some 25 apps subsequently disappeared from app stores, which means that Didi has been unable to solicit new customers since then.

On 8 July 2021, Chinese regulatory authorities handed Didi a 8.026-billion-yuan fine (1.2 billion dollars) for allegedly violating the country’s anti-monopoly law. The company’s stock price subsequently crashed.

The Chinese state has shown that it is determined to subordinate digital corporations to state objectives.

The authorities do not like it when Chinese tech companies are listed on stock exchanges in the US because then they fall under the jurisdiction of US regulatory bodies. In the interim, Didi has announced that it will withdraw from the NYSE.

The Chinese crackdown has cost the company billions in lost revenue. In July of this year, oversight officials published the results of their investigation. In addition to the fines levied against the company, Didi executives Will Cheng Wei and Jean Liu Qing were each fined 1 million yuan. Didi announced on its Weibo account that it fully accepts the regulators’ decision and will correct its misconduct.

During the “crackdown”, as the Chinese offensive to put the digital corporation in its place was called, the company also spoke out against “996”, a Chinese term for a work schedule that was common in the tech industry for a long time: from 9:00 to 21:00, six days per week. There are also persistent rumours that the state wants to take over Didi, or parts of it, in order to have direct influence over its business policies.

Moving Forward

In the transport sector, China is attempting to move forward on three megatrends: electrification, driverless vehicles, and new transport concepts. Chinese digital corporations like Didi Chuxing play an important role in them all.

In this area, there are deep, interconnected conflicts between long-term political objectives like environmental protection, transport planning, and funding domestic industries through regulatory provisions in a profit-oriented, start-up environment.

The Chinese platform economy tends to lead to problems similar to those of its Western counterparts. However, the Chinese state has shown that it is positioned to take more intensive countermeasures and that it is determined to subordinate digital corporations to state objectives. At the same time, there is less public debate in China, and worker self-organization is more difficult. Options for bottom-up approaches are less developed.

These conflicts will likely continue in the coming years, especially given that, triggered by a trade war and the COVID-19 pandemic, China entered a new phase in 2020, with a more intensive focus on the domestic market and the expansion of the digital service industry.